Do you recall the laborious and time-consuming task of tracking the prices of stocks and entering the records manually on spreadsheets? This tedious work involved typing a word or two into a search engine, copying some numbers, and then entering them into different cells of the spreadsheet. You then proceed with other stock, and a few minutes pass by, and you realize the prices of several stocks have changed, leaving you outdated already! You then grab the printed sheets and realize that you jumbled and messed up the prices of different stocks.

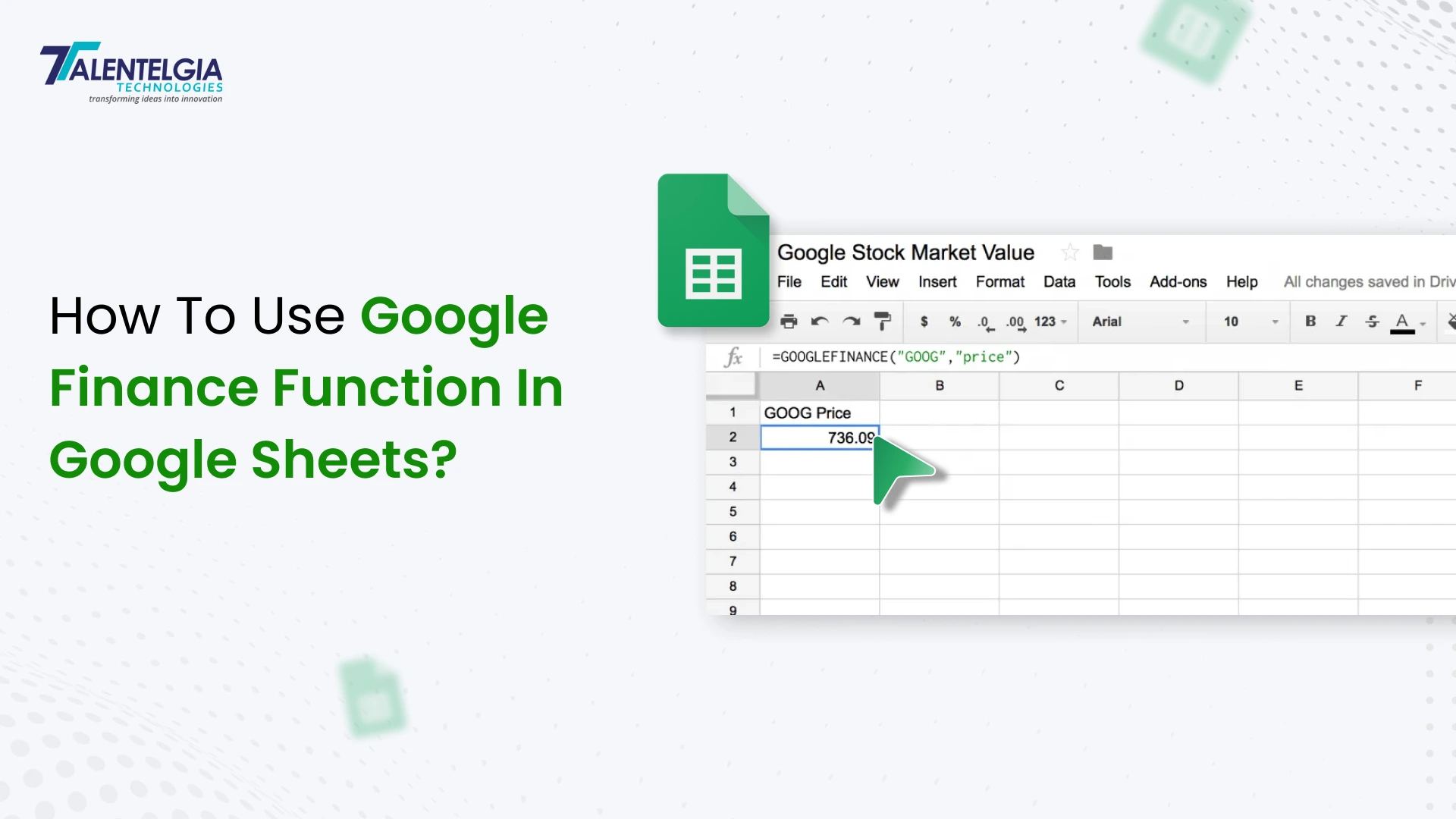

Many people have experienced this and hope never to repeat it again. Fortunately, the invention of the Google Sheets feature called “Google Finance” has made it easier to reduce the time-consuming processes and organize information in the most structured way. It’s almost like having a finance-savvy assistant. With the Google Finance function, you can effortlessly import real-time financial data, historical stock prices, and currency exchange rates directly into your Google Sheets.

Understanding Google Finance Function: Syntax Breakdown

Many of you are familiar with Google Finance as a tool to explore investment options and other financial data. It enables you to build and manage your own stock portfolio, tracking it in real time. Additionally, it provides updates on securities, currency exchange rates, and more, all in one convenient location. What you might not know is that Google Sheets offers a special formula called “GOOGLEFINANCE.” This formula lets you pull in data directly from Google Finance into your spreadsheets.

For more insights on improving your financial strategies, you may also want to check out Top 7 Financial Analysis Tools To Boost Your Business ….

The formula can seem a bit complex at first, so we’ve created this easy-to-follow guide to help you master GOOGLEFINANCE confidently and without hassle..

What Is Google Finance Formula?

At its core, the GOOGLEFINANCE function fetches current or historical securities information, such as stock prices, exchange rates, or market capitalization for publicly traded companies and currencies worldwide. The function takes a ticker symbol (a short code identifying stocks or currencies), a data attribute to specify the type of information you want, and optional parameters like date ranges and intervals.

Key Features & Advantages:

- Real-time and historical data access: Pull live stock prices or detailed historical pricing and volume trends effortlessly.

- Supports stocks, mutual funds, currencies, and indices: Versatility to cover multiple asset classes and markets globally.

- Customizable data retrieval: Specify attributes such as price, volume, market cap, P/E ratio, and many more.

- Dynamic updates: Your sheet automatically refreshes data to reflect changes in the financial markets.

- Simple syntax: A user-friendly formula with flexible parameters that anyone familiar with spreadsheets can master.

- Automate investment tracking and budgeting: Build dashboards or conversion tools with accurate, up-to-date financial data without external software or APIs.

Mastering the Google Finance formula empowers you to bring the complexity of financial markets within easy reach, all while leveraging Google Sheets’ robust calculation and organizational capabilities. This guide will help you navigate from basic queries to creating advanced, insightful financial analyses step by step.

Syntax of Google Finance Function

The GOOGLEFINANCE function in Google Sheets is designed to fetch real-time or historical financial data from Google Finance straight into your spreadsheet with ease. Understanding its syntax is essential to harnessing its full potential for tracking stocks, currencies, and other market data.

Basic Syntax of the function :

=GOOGLEFINANCE(ticker, [attribute], [start_date], [end_date|num_days], [interval])Let’s break down its components to see what each part means and how to use them:

- Ticker (required): This is the symbol that identifies the security or currency you want information about. It’s usually a combination of the stock exchange and the ticker symbol separated by a colon, for example, “NASDAQ: GOOG” for Google’s stock on NASDAQ. For currency exchange rates, it looks like “CURRENCY: USDGBP” to convert USD to GBP. Always enclose the ticker in quotes.

- Attribute (optional): Defines what type of financial data to retrieve. Some common attributes include “price” (real-time price), “priceopen” (opening price for the day), “high” (highest price of the day), “low” (lowest price), “volume”, “marketcap”, and “pe” (price-to-earnings ratio). If you leave this blank, it defaults to “price”.

- start_date (optional): The starting date for historical data you want to retrieve. Use standard date formats and enclose the date in quotes or reference a cell containing a date. If omitted, the function assumes today’s date.

- end_date|num_days (optional): Specifies either the end date for historical data or the number of days from the start date to retrieve data for. Omitting this parameter results in data for a single day if start_date is provided.

- Interval (optional): Defines the frequency of the data, such as “DAILY” or “WEEKLY”. The default is “DAILY”.

Attributes to Use In Google Sheets:

Here is a table of the common GOOGLEFINANCE attributes separated into real-time and historical data categories:

| Attribute (Real-Time Data) | Description |

| “price” | Real-time stock price (delayed up to 20 minutes) |

| “priceopen” | Opening price of the current trading day |

| “high” | Highest price of the current trading day |

| “low” | Lowest price of the current trading day |

| “volume” | Trading volume for the current day |

| “marketcap” | Market capitalization of the stock |

| “tradetime” | Time of the last trade |

| “datadelay” | Delay time of the real-time data |

| “volumeavg” | Average daily trading volume |

| “pe” | Price-to-earnings ratio |

| “eps” | Earnings per share |

| “high52” | Highest price over the last 52 weeks |

| “low52” | Lowest price over the last 52 weeks |

| “change” | Change in stock price since the previous close |

| “changepct” | Percentage change since previous close |

| “closeyest” | Previous day’s closing price |

| “beta” | Beta value (volatility indicator) |

| “shares” | Number of outstanding shares |

| “currency” | Currency in which the stock is priced |

| Attribute (Historical Data) | Description |

| “open” | Opening price during the specified period |

| “close” | Closing price during the specified period |

| “high” | Highest price during the specified period |

| “low” | Lowest price during the specified period |

| “all” | Returns open, close, high, low, and volume data for the period |

| “volume” | Trading volume during the specified period |

Using Google Finance Formula In Google Sheet: Step-by-Step Tutorial

The GOOGLEFINANCE function can seem like magic—it pulls live financial data straight into your spreadsheets, empowering you to track markets, analyze trends, and make smarter decisions. Here’s a practical, step-by-step tutorial covering the key use cases.

1. Track Stocks Using the GOOGLEFINANCE Formula

Tracking a stock’s current price or trading data in Google Sheets is as simple as plugging in the ticker symbol.

- Basic real-time price:

=GOOGLEFINANCE("NASDAQ:GOOG") This returns Google’s current stock price, delayed by up to 20 minutes due to market data restrictions.

- Tracking multiple attributes: Add an attribute to fetch more details

=GOOGLEFINANCE("NASDAQ:GOOG", "priceopen") Returns today’s opening price. You can retrieve volume, market cap, P/E ratio, and others by changing the attribute. You can also feed a list of stocks and drag the formula down to auto-fill prices for a whole portfolio.

2. Get Historical Stock Data

For trend analysis or backtesting, historical stock prices are invaluable.

- Get closing prices over a date range:

=GOOGLEFINANCE("NASDAQ:MSFT", "close", DATE(2023,1,1), DATE(2023,1,31), "DAILY") This brings the daily closing prices for Microsoft in January 2023.

- Change interval:

Swap “DAILY” for “WEEKLY” to get weekly data points instead.

Historical queries pull complete tables, starting at your cell with dates in the first column and the specified attribute in the second, ideal for charting and deeper analysis.

3. Working with Currency

GOOGLEFINANCE also supports currency pairs, letting you track exchange rates live or historically.

- Track currency exchange rate: Returns how many British Pounds one US Dollar will buy right now.

=GOOGLEFINANCE("CURRENCY:USDGBP") - Historical currency rates: Fetches the daily closing rate for USD to Euro in June 2023.

=GOOGLEFINANCE("CURRENCY:USDEUR", "close", DATE(2023,6,1), DATE(2023,6,30), "DAILY")This makes budgeting for travel, imports, or analyzing forex easy and automatic.

4. Get Currency Exchange Value

Working with currency conversions is often complex, but GOOGLEFINANCE simplifies it.

- Convert amounts using live rates: If you want to convert 100 USD to GBP:

=100 * GOOGLEFINANCE("CURRENCY:USDGBP") This multiplies your amount by the real-time conversion rate.

- Create dynamic conversion tables: List currencies in one column and apply the formula next to each, creating instant conversion dashboards.

How Often Does GOOGLEFINANCE Function Update The Google Sheets?

GOOGLEFINANCE updates data roughly every 2 minutes, but actual market data may be delayed up to 20 minutes depending on the exchange. Google Sheets refreshes data when you open the file or make edits, and you can adjust recalculation settings to refresh more frequently. However, completely real-time data is not guaranteed, especially outside market hours.

Is Relying on GOOGLEFINANCE Function a Good Idea?

For most users, Yes! GOOGLEFINANCE is a free, easy way to import live and historical financial data without third-party tools. It’s perfect for investors, students, or small businesses needing quick insights. That said, it’s not ideal for high-speed trading or professional analytics, due to potential delays and limited advanced data. Overall, it’s a powerful, accessible tool for everyday financial tracking and analysis.

Wrapping It Up!

GOOGLEFINANCE turns your spreadsheet into a powerful financial command center—whether you’re following stocks, exploring historical trends, or managing currencies. The best part? It keeps your data up to date without manual fuss, freeing you to focus on analysis and decisions, not data entry.

This tutorial gives you a practical foundation, but combining GOOGLEFINANCE with other spreadsheet functions like IF, QUERY, or SPARKLINE can elevate your reports even further.

Time to grab a sheet and start experimenting!

Also Read: Finance Web Development

Healthcare App Development Services

Healthcare App Development Services

Real Estate Web Development Services

Real Estate Web Development Services

E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce Development Company

Blockchain E-commerce Development Company

Fintech App Development Services

Fintech App Development Services Fintech Web Development

Fintech Web Development Blockchain Fintech Development Company

Blockchain Fintech Development Company

E-Learning App Development Services

E-Learning App Development Services

Restaurant App Development Company

Restaurant App Development Company

Mobile Game Development Company

Mobile Game Development Company

Travel App Development Company

Travel App Development Company

Automotive Web Design

Automotive Web Design

AI Traffic Management System

AI Traffic Management System

AI Inventory Management Software

AI Inventory Management Software

AI Software Development

AI Software Development  AI Development Company

AI Development Company  AI App Development Services

AI App Development Services  ChatGPT integration services

ChatGPT integration services  AI Integration Services

AI Integration Services  Generative AI Development Services

Generative AI Development Services  Natural Language Processing Company

Natural Language Processing Company Machine Learning Development

Machine Learning Development  Machine learning consulting services

Machine learning consulting services  Blockchain Development

Blockchain Development  Blockchain Software Development

Blockchain Software Development  Smart Contract Development Company

Smart Contract Development Company  NFT Marketplace Development Services

NFT Marketplace Development Services  Asset Tokenization Company

Asset Tokenization Company DeFi Wallet Development Company

DeFi Wallet Development Company Mobile App Development

Mobile App Development  IOS App Development

IOS App Development  Android App Development

Android App Development  Cross-Platform App Development

Cross-Platform App Development  Augmented Reality (AR) App Development

Augmented Reality (AR) App Development  Virtual Reality (VR) App Development

Virtual Reality (VR) App Development  Web App Development

Web App Development  SaaS App Development

SaaS App Development Flutter

Flutter  React Native

React Native  Swift (IOS)

Swift (IOS)  Kotlin (Android)

Kotlin (Android)  Mean Stack Development

Mean Stack Development  AngularJS Development

AngularJS Development  MongoDB Development

MongoDB Development  Nodejs Development

Nodejs Development  Database Development

Database Development Ruby on Rails Development

Ruby on Rails Development Expressjs Development

Expressjs Development  Full Stack Development

Full Stack Development  Web Development Services

Web Development Services  Laravel Development

Laravel Development  LAMP Development

LAMP Development  Custom PHP Development

Custom PHP Development  .Net Development

.Net Development  User Experience Design Services

User Experience Design Services  User Interface Design Services

User Interface Design Services  Automated Testing

Automated Testing  Manual Testing

Manual Testing  Digital Marketing Services

Digital Marketing Services

Ride-Sharing And Taxi Services

Ride-Sharing And Taxi Services Food Delivery Services

Food Delivery Services Grocery Delivery Services

Grocery Delivery Services Transportation And Logistics

Transportation And Logistics Car Wash App

Car Wash App Home Services App

Home Services App ERP Development Services

ERP Development Services CMS Development Services

CMS Development Services LMS Development

LMS Development CRM Development

CRM Development DevOps Development Services

DevOps Development Services AI Business Solutions

AI Business Solutions AI Cloud Solutions

AI Cloud Solutions AI Chatbot Development

AI Chatbot Development API Development

API Development Blockchain Product Development

Blockchain Product Development Cryptocurrency Wallet Development

Cryptocurrency Wallet Development About Talentelgia

About Talentelgia  Our Team

Our Team  Our Culture

Our Culture

Healthcare App Development Services

Healthcare App Development Services Real Estate Web Development Services

Real Estate Web Development Services E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce

Development Company

Blockchain E-commerce

Development Company Fintech App Development Services

Fintech App Development Services Finance Web Development

Finance Web Development Blockchain Fintech

Development Company

Blockchain Fintech

Development Company E-Learning App Development Services

E-Learning App Development Services Restaurant App Development Company

Restaurant App Development Company Mobile Game Development Company

Mobile Game Development Company Travel App Development Company

Travel App Development Company Automotive Web Design

Automotive Web Design AI Traffic Management System

AI Traffic Management System AI Inventory Management Software

AI Inventory Management Software AI Software Development

AI Software Development AI Development Company

AI Development Company ChatGPT integration services

ChatGPT integration services AI Integration Services

AI Integration Services Machine Learning Development

Machine Learning Development Machine learning consulting services

Machine learning consulting services Blockchain Development

Blockchain Development Blockchain Software Development

Blockchain Software Development Smart contract development company

Smart contract development company NFT marketplace development services

NFT marketplace development services IOS App Development

IOS App Development Android App Development

Android App Development Cross-Platform App Development

Cross-Platform App Development Augmented Reality (AR) App

Development

Augmented Reality (AR) App

Development Virtual Reality (VR) App Development

Virtual Reality (VR) App Development Web App Development

Web App Development Flutter

Flutter React

Native

React

Native Swift

(IOS)

Swift

(IOS) Kotlin (Android)

Kotlin (Android) MEAN Stack Development

MEAN Stack Development AngularJS Development

AngularJS Development MongoDB Development

MongoDB Development Nodejs Development

Nodejs Development Database development services

Database development services Ruby on Rails Development services

Ruby on Rails Development services Expressjs Development

Expressjs Development Full Stack Development

Full Stack Development Web Development Services

Web Development Services Laravel Development

Laravel Development LAMP

Development

LAMP

Development Custom PHP Development

Custom PHP Development User Experience Design Services

User Experience Design Services User Interface Design Services

User Interface Design Services Automated Testing

Automated Testing Manual

Testing

Manual

Testing About Talentelgia

About Talentelgia Our Team

Our Team Our Culture

Our Culture

Write us on:

Write us on:  Business queries:

Business queries:  HR:

HR: