We’re living in an economically fragile world where mastering personal finance is one of the few domains that adds some degree of certainty to life. Perhaps, this explains why there has been a massive boom in ‘Personal Financing Apps’ that effortlessly track, optimize, and manage financial status, with new offerings for users every day. The widespread adoption of smartphones and growing financial literacy among people have made banking and finance apps crucial for the seamless management of budgets, investments, and expenditures.

According to a report from Zion Market Research, the global finance app service market was worth $101.75 billion in 2023, which is projected to grow to $675.8 billion by the year 2032 with a CAGR of 23.40% during the forecast period. Additionally, since everyone spends money on online shopping, groceries, ride booking, etc., the report further indicated that revenue growth from banking Fintech app development services will most likely be the fastest among other industries. Thus, diving into the world of banking & finance services offers exciting reasons to seize the opportunities in this thriving industry.

But before you move further, there is one big question: How much does personal finance app development cost? In this article, we will share a detailed analysis of the cost per development stage and also explain the efforts that go behind it.

What Is a Personal Finance App?

Simply put, a Personal Financing App is a smartphone application that helps users manage their money. Users can add and modify their credit/debit cards and bank account details, set up categories for income and expenditures, and track their fund records. Typically, these applications are very basic in terms of User interface design and user experience, so they’re easy to operate. However, one shouldn’t confuse such software with a banking app since the latter revolves around the cards and accounts of one specific bank. On the other hand, financial management apps provide a detailed summary of how users manage their wallets.

There are countless applications in the Google Play Store and Apple App Store, such as Mint, YNAB, and PayPal, that have changed the way people manage their finances. As developers try to come up with the most unique product, the way the app functions differs to a great extent. Nonetheless, a typical package of a personal finance software app usually has the following features:

- Budget planning

- Calculating your income or expenses and balancing them

- Reserve funds for future needs

- Analyzing your spending habits to identify the areas that consume most of your finances.

So if you’re thinking of developing a fintech app, knowing the cost structure will help you determine your budget and level of success.

What are The Key Factors that Decide The Cost of Building a Personal Financial App?

The cost to develop a personal finance app may differ significantly from one project to another based on many factors, such as the functionality you want to implement, the complexity of your app, and the level of expertise of the development team you hire.

A simple personal finance app, such as a personal budgeting app or expense tracker, including budget money management apps with limited features, will probably cost you $35,000 – $75,000 USD. For starters, you might want to build a basic app with minimal useful features if you have budget constraints. Then, you can keep adding more valuable features along the way, as per your budget. You can work with a professional app development company like Talentelgia, which will give you a quote on the pricing overview.

Here is a table that will give you an overview of the pricing structure as per the features:

| Aspect/Features | Basic App | Advanced App | Enterprise-level App |

|---|---|---|---|

| App Complexity | $10,000 – $20,000 | $20,000 – $50,000 | $100,000+ |

| Platform | $5000 – $10,000 | $15,000 – $30,000 | $50,000+ |

| UI/UX Design | $3,000 – $7,000 | $10,000 – $20,000 | $30,000+ |

| Backend Development | $5,000 – $15,000 | $25,000 – $50,000 | $100,000+ |

| Third-Party Integrations | $2,000 – $5,000 | $10,000 – $20,000 | $50,000+ |

| Security Features | $3,000 – $5,000 | $10,000 – $20,000 | $30,000 |

| Total Estimated Cost | $20,000 – $50,000 | $50,000 – $150,000 | $200,000+ |

1. Development Cost

Hourly Rates of Engineers: The hourly fees charged by the developers vary widely depending on where the development team is located, since the cost of living, demand, and talent acquisition can influence overall rates. Below is an estimated hourly rates for software engineers in various countries as per data from multiple sources:

| Location | Hourly Rates |

|---|---|

| United States | $70 – $150 /hour |

| United Kingdom | $45 – $100 /hour |

| Canada | $60 – $120 /hour |

| India | $20 – $50 /hour |

| Eastern Europe | $30 – $65 /hour |

| Western Europe | $65 – $130 /hour |

| Southeast Asia | $10 – $30 /hour |

- Estimated Time for Features: Every feature on a personal financing app is different, so the time taken to develop them will be different too. The total time depends on the feature’s complexity, technology used, and details. Nevertheless, here are some average estimated times to implement different features:

BASIC FEATURES:

| Feature | Estimated Time (hours) |

|---|---|

| Expense Tracking | 50 – 100 hrs |

| Budgeting | 50 – 150 hrs |

| Goal Setting | 50 – 150 hrs |

| Bill Reminders | 30 – 100 hrs |

| Security | 100 – 300 hrs |

ADVANCED FEATURES:

| Feature | Estimated Time (hours) |

|---|---|

| Integration with financial institutions | 200 – 300 hrs |

| Retirement plan tools | 100 – 300 hrs |

| Customizable alerts | 30 – 100 hrs |

| Tax management | 100 – 150 hrs |

| Debt payoff calculator | 50 – 150 hrs |

| Investment analysis | 100 – 300 hrs |

ENTERPRISE FEATURES:

| Feature | Estimated Time (hours) |

|---|---|

| AI-powered assistant | 200 – 500 hrs |

| Virtual assistant | 100 – 300 hrs |

| Gamification feature | 30 – 100 hrs |

| Collaboration feature | 50 – 150 hrs |

| Financial education & resources | 50 – 150 hrs |

| Credit score tracking & improvement | 100 – 150 hrs |

| Automatic savings | 30 – 100 hrs |

| Advanced data security & privacy | 200 – 400 hrs |

| Social responsibility & sustainability | 50 – 150 hrs |

2. Other Expenses

We have covered most of the significant expenses that you would expect. However, there are a few other areas where you have to factor in some extra costs:

Cost of Hosting and Infrastructure: These are critical, recurring costs beyond core development that ensure your app launches, operates, and grows successfully.

- Initial (MVP): $50 – $200 /month

- Growth: $300 – $1000+ /month

- Large Scale: $5000 – $20,000+ /month

- Annual Estimate: $3,600 – $12,000+ /month (initial years)

Cost of Marketing and Promotion: Essential for user acquisition and visibility in the crowded market. It’s how people find your app.

- ASO/Content: $200 – $1000 /month

- Paid Ads (PPC): $500 – $2000 /month

- Aggressive Growth: $5000 – $20,000+ /month

- Annual Estimate: $10,000 – $50,000+ /month

App Store Fees: Necessary fees to publish and monetize on the Apple App Store and Google’s App Store.

- Developer Accounts: $99 /year (Apple) +$25 one-time payment (Google) = ~$120 annually

- Transaction Fees: 15%—30% of any in-app purchases/subscriptions, which directly impact revenue as your app grows.

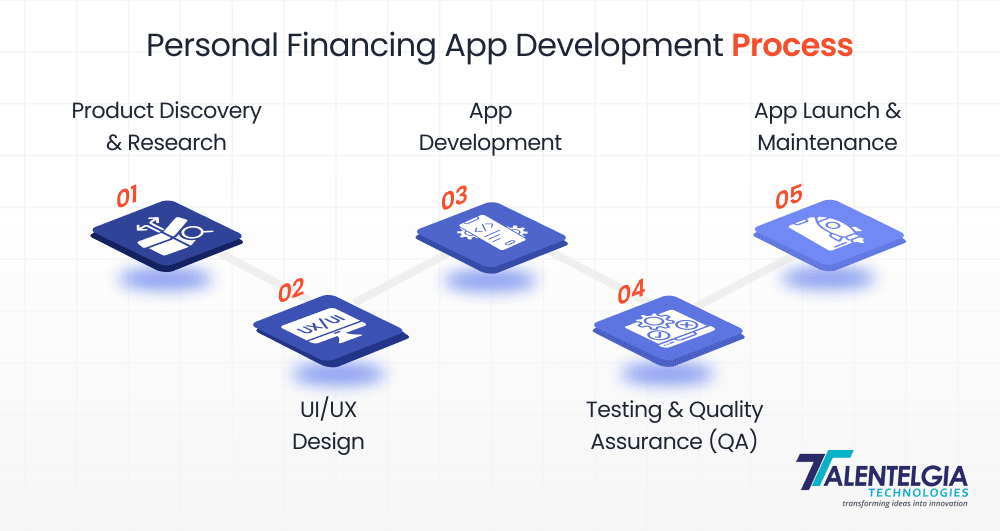

5 Key Processes to Build a Personal Financial App

Building a mobile application for managing personal finances requires careful planning and attention to detail, especially regarding security and efficiency. From the very beginning to the end, the development process requires setting goals, choosing relevant technologies, designing a user interface, building strong security protocols, performing extensive testing, and creating a comprehensive financial management application that prioritizes user needs.

So, let’s get straight into the topic and discuss the personal financing app development process:

1. Product Discovery and Research

First things first, do your research. Begin by gathering the “User” and “Market” information and identifying which of the Must-, Should-, Could-, and Wo n’t-haves apply to your product.

Discovery (or business analysis & research) lays the foundation of your project, so you shouldn’t skip this step. The discovery phase will provide an opportunity to learn more about your target audience and market niche. Still, it will also allow you to test your idea and not waste any unnecessary costs during the app development process. It usually includes:

- User Research: Search for an audience that might find the app relevant. Then, make a list of questions and research the target market. This includes conducting surveys and follow-up interviews on the phone about their needs and pain points.

- Competitive Analysis: This process will allow you to recognize weaknesses in your competitors that you can exploit and fill the gap with your offerings. Discover their strengths and weaknesses and how they might affect your business. Customer reviews can be a great tool in this step.

- Product Analysis & Risk Evaluation: If doing research and taking interviews validates the need for your software product, get your team to assess the potential risks and determine the ideas that would be applied. Choose the correct set of features, project, scope, and monetization model.

2. UI/UX Design

After choosing a solid concept, the next step is to start working on the user interface (UI) and user experience (UX) design. At this point, designers create wireframes for the UI and set the design style, graphics, color scheme, typography, etc. For UX, it is essential to design user flow and invest in analyzing user journeys. Most part of the MVP’s success depends on user-friendliness and UX of the app, so make sure you put 100% of your effort into it.

This is a useful tip! Keep it simple to build trust and a sense of security, which is crucial for a successful fintech app. While it might be tempting to use all the latest and premium design elements, remember that nothing should take your user’s attention away from their destination. Otherwise, they won’t be interested in your product.

3. App Development

This is the stage at which the development team behind your finance app begins coding the app base. So, choose the best technology stack to develop your Android app or IOS application to ensure the scalability, availability, and security of your platform. For example, you can adopt frameworks like React Native to build cross-platform applications or let APIs allow you to use financial data embedded in your app. This tech stack is what governs the simplicity and reliability of your app.

You would have to hire both a frontend and a backend developer. You can also recruit one full-stack coder who can do both, but then the development will take longer. This is tightly related to the process of quality assurance (QA) in the next step.

4. Testing and Quality Assurance (QA)

By testing and doing some QA work, you ensure the final deliverable is of higher quality. The QA phase allows you to identify and address any bugs and ensure that the financial management software functions perfectly while being used on any device. Full-scale testing, both functional and non-functional, such as compatibility, performance, and security testing, ensures that your product is a reliable financial property for users and offers them a seamless experience.

QA Experts perform rigorous testing to identify and fix any bugs or issues, and get the app to be stable and run smoothly. This phase will help you know how they think about the product, what they do and don’t like about it, and/or what it’s missing. After that, collect feedback and determine the next areas of growth.

5. App Launch and Maintenance

The finance app is developed and tested, and then deployed across various platforms. It is necessary to keep gathering user feedback, not only in the initial stages but also post-launch as your app grows and develops. Track its performance and app analytics to evaluate its success and find possible ways of improvement. Ongoing monitoring enables timely updates, fixes, and improvements to the app to make sure it’s as relevant and competitive as possible in the fast-moving finance app space.

With user reviews up your sleeve, it’s high time for you to map out updates and enhancements on your personal finance app. Once released, you will need to update the software to provide users with a bug-free experience, a solid working app, or to improve the app’s safety later.

Also Read: How Much Does it Cost to Maintain an App?

Final Thoughts

With that note, we have finally reached the end of this blog. We believe we have been able to clear your queries about the personal finance app development cost. It is essential to understand that the above prices can vary significantly based on several factors we discussed. Plus, you will have to partner with a reliable fintech app development company to develop a feature-rich app at cost-effective rates.

Talentelgia is a leading software development company with years of skills and experience. So, what are you waiting for? Contact us and get your finance app project started today!

Healthcare App Development Services

Healthcare App Development Services

Real Estate Web Development Services

Real Estate Web Development Services

E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce Development Company

Blockchain E-commerce Development Company

Fintech App Development Services

Fintech App Development Services Fintech Web Development

Fintech Web Development Blockchain Fintech Development Company

Blockchain Fintech Development Company

E-Learning App Development Services

E-Learning App Development Services

Restaurant App Development Company

Restaurant App Development Company

Mobile Game Development Company

Mobile Game Development Company

Travel App Development Company

Travel App Development Company

Automotive Web Design

Automotive Web Design

AI Traffic Management System

AI Traffic Management System

AI Inventory Management Software

AI Inventory Management Software

AI Software Development

AI Software Development  AI Development Company

AI Development Company  AI App Development Services

AI App Development Services  ChatGPT integration services

ChatGPT integration services  AI Integration Services

AI Integration Services  Generative AI Development Services

Generative AI Development Services  Natural Language Processing Company

Natural Language Processing Company Machine Learning Development

Machine Learning Development  Machine learning consulting services

Machine learning consulting services  Blockchain Development

Blockchain Development  Blockchain Software Development

Blockchain Software Development  Smart Contract Development Company

Smart Contract Development Company  NFT Marketplace Development Services

NFT Marketplace Development Services  Asset Tokenization Company

Asset Tokenization Company DeFi Wallet Development Company

DeFi Wallet Development Company Mobile App Development

Mobile App Development  IOS App Development

IOS App Development  Android App Development

Android App Development  Cross-Platform App Development

Cross-Platform App Development  Augmented Reality (AR) App Development

Augmented Reality (AR) App Development  Virtual Reality (VR) App Development

Virtual Reality (VR) App Development  Web App Development

Web App Development  SaaS App Development

SaaS App Development Flutter

Flutter  React Native

React Native  Swift (IOS)

Swift (IOS)  Kotlin (Android)

Kotlin (Android)  Mean Stack Development

Mean Stack Development  AngularJS Development

AngularJS Development  MongoDB Development

MongoDB Development  Nodejs Development

Nodejs Development  Database Development

Database Development Ruby on Rails Development

Ruby on Rails Development Expressjs Development

Expressjs Development  Full Stack Development

Full Stack Development  Web Development Services

Web Development Services  Laravel Development

Laravel Development  LAMP Development

LAMP Development  Custom PHP Development

Custom PHP Development  .Net Development

.Net Development  User Experience Design Services

User Experience Design Services  User Interface Design Services

User Interface Design Services  Automated Testing

Automated Testing  Manual Testing

Manual Testing  Digital Marketing Services

Digital Marketing Services

Ride-Sharing And Taxi Services

Ride-Sharing And Taxi Services Food Delivery Services

Food Delivery Services Grocery Delivery Services

Grocery Delivery Services Transportation And Logistics

Transportation And Logistics Car Wash App

Car Wash App Home Services App

Home Services App ERP Development Services

ERP Development Services CMS Development Services

CMS Development Services LMS Development

LMS Development CRM Development

CRM Development DevOps Development Services

DevOps Development Services AI Business Solutions

AI Business Solutions AI Cloud Solutions

AI Cloud Solutions AI Chatbot Development

AI Chatbot Development API Development

API Development Blockchain Product Development

Blockchain Product Development Cryptocurrency Wallet Development

Cryptocurrency Wallet Development About Talentelgia

About Talentelgia  Our Team

Our Team  Our Culture

Our Culture

Healthcare App Development Services

Healthcare App Development Services Real Estate Web Development Services

Real Estate Web Development Services E-Commerce App Development Services

E-Commerce App Development Services E-Commerce Web Development Services

E-Commerce Web Development Services Blockchain E-commerce

Development Company

Blockchain E-commerce

Development Company Fintech App Development Services

Fintech App Development Services Finance Web Development

Finance Web Development Blockchain Fintech

Development Company

Blockchain Fintech

Development Company E-Learning App Development Services

E-Learning App Development Services Restaurant App Development Company

Restaurant App Development Company Mobile Game Development Company

Mobile Game Development Company Travel App Development Company

Travel App Development Company Automotive Web Design

Automotive Web Design AI Traffic Management System

AI Traffic Management System AI Inventory Management Software

AI Inventory Management Software AI Software Development

AI Software Development AI Development Company

AI Development Company ChatGPT integration services

ChatGPT integration services AI Integration Services

AI Integration Services Machine Learning Development

Machine Learning Development Machine learning consulting services

Machine learning consulting services Blockchain Development

Blockchain Development Blockchain Software Development

Blockchain Software Development Smart contract development company

Smart contract development company NFT marketplace development services

NFT marketplace development services IOS App Development

IOS App Development Android App Development

Android App Development Cross-Platform App Development

Cross-Platform App Development Augmented Reality (AR) App

Development

Augmented Reality (AR) App

Development Virtual Reality (VR) App Development

Virtual Reality (VR) App Development Web App Development

Web App Development Flutter

Flutter React

Native

React

Native Swift

(IOS)

Swift

(IOS) Kotlin (Android)

Kotlin (Android) MEAN Stack Development

MEAN Stack Development AngularJS Development

AngularJS Development MongoDB Development

MongoDB Development Nodejs Development

Nodejs Development Database development services

Database development services Ruby on Rails Development services

Ruby on Rails Development services Expressjs Development

Expressjs Development Full Stack Development

Full Stack Development Web Development Services

Web Development Services Laravel Development

Laravel Development LAMP

Development

LAMP

Development Custom PHP Development

Custom PHP Development User Experience Design Services

User Experience Design Services User Interface Design Services

User Interface Design Services Automated Testing

Automated Testing Manual

Testing

Manual

Testing About Talentelgia

About Talentelgia Our Team

Our Team Our Culture

Our Culture

Write us on:

Write us on:  Business queries:

Business queries:  HR:

HR: